On Friday, March 31, 2023, the Department of the Treasury and the Internal Revenue Service released a notice of proposed rulemaking regarding amendments to Section 30D of the Internal Revenue Code (“Code”). Section 30D was originally enacted by the Energy Improvement and Extension Act of 2008 to provide tax credits for the purchase of a new qualified plug-in electric drive motor vehicle. Under the Inflation Reduction Act of 2022 (“IRA”), the 2023 amendments to Section 30D, are intended to move electric vehicle (“EV”) supply chains to North America.

The New Clean Vehicle Credit (“Credit”) provides a total of $7,500 in available tax credits for new “clean motor vehicles.” Those that meet a critical minerals requirement are eligible for a $3,750 tax credit, and vehicles that meet a battery components requirement are eligible for a $3,750 tax credit.

Comments are due within 60 days of publication, which is currently scheduled for April 17, 2023.

What Vehicles May Qualify?

The proposed changes to the Code update the definition of EVs so that only New Clean Vehicles (“NCVs”) may be eligible for the Section 30D Credit. To be considered an NCV, a motor vehicle must satisfy eight criteria:

- The original use of the motor vehicle must commence with the taxpayer;

- The motor vehicle must be acquired for use or lease by the taxpayer and not for resale;

- The motor vehicle must be made by a qualified manufacturer;

- The motor vehicle must be treated as a motor vehicle for purposes of title II of the Clean Air Act;

- The motor vehicle must have a gross vehicle weight rating of less than 14,000 pounds;

- The motor vehicle must be propelled to a significant extent by an electric motor which draws electricity from a battery that has a capacity of not less than 7 kilowatt hours, and is capable of being recharged from an external source of electricity;

- The final assembly of the motor vehicle must occur within North America (defined by the proposed regulations as the United States, Mexico, or Canada);

- The person who sells any vehicle to the taxpayer must furnish a report to the taxpayer and to the Secretary, at such time and in such manner as the Secretary provides, containing specifically enumerated items.

If a vehicle meets these eight requirements, it may be eligible for credits of up to $7,500, depending on the critical mineral and battery component requirements.

Critical Mineral Requirements

Under 30D(e)(1)(A) of the Code, a specified percentage of the value of the applicable critical minerals contained in an NCV battery (as defined in section 45X(c)(6)) must be:

- Extracted or processed in the United States, or in any country with which the United States has a free trade agreement in effect; OR

- Recycled in North America.

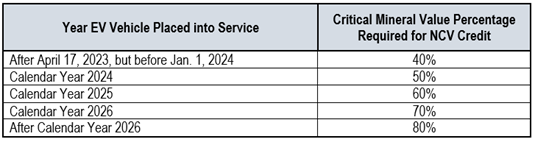

The specified percentages depend on when the NCV was placed into service:

To calculate the critical minerals requirement, the manufacturer must first document the “procurement chain” for each individual critical mineral. The proposed regulations state that when determining the share of the value of the critical mineral, the entire value of the critical mineral will be considered to have met that criteria if 50 percent or more of the value of the mining, extraction or processing takes place in the United States or in an FTA partner country. Treasury also includes a temporary alternative methodology whereby the entire value of the critical mineral will be considered to have met the criteria if 50 percent or more of the value added to the critical mineral because of processing in the United States or in an FTA partner country.

Once the manufacturer has documented the value of the critical minerals, the manufacturer uses that value to calculate qualifying critical mineral content. This calculation is the share of the total value of all critical minerals incorporated in the battery accounted for by the critical minerals extracted or processed in the United States or an FTA partner country. If that share meets or exceeds the minimum requirement for the relevant year then the critical mineral criteria is satisfied. The Proposed Regulations provide manufacturers the option of performing this calculation for each individual battery or the option to average the qualifying critical mineral content over a limited period of time. The Proposed Regulations explicitly request public feedback on this rule.

If the critical minerals in the battery of the NCV are greater than or equal to the percentages listed above, the vehicle may qualify for a credit of $3,750.00.

Battery Component Requirements

Section 30D of the Code defines what constitutes a “battery component.” This includes any piece of the assembled battery cell that contributes to electrochemical energy storage. The definition includes, but is not limited to: a cathode electrode, anode electrode, solid metal electrode, separator, liquid electrolyte, solid state electrolyte, battery cell, and battery module. Excluded from the definition of battery components are constituent materials, even though such constituent materials may be manufactured or assembled into battery components.

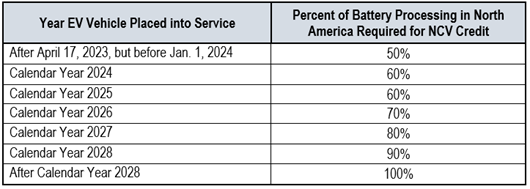

Under 30D(e)(2)(A) of the Code, a specified percentage of the battery from which the electric motor of a vehicle draws electricity must be manufactured or assembled in North America. The specified percentages also depend on when the NCV was placed into service:

The manufacturer calculates the “incremental value” of the battery components manufactured in North America and if the share of the qualifying battery components to the total aggregated value of all components exceeds the minimum requirements for that year, then the battery component criteria is satisfied. Like the criteria for the critical mineral requirement, a manufacturer may perform this calculation for each individual battery or may average the calculation over a limited period of time. Treasury has also requested public comment on how the averaging calculation should operate for the battery component criteria.

If the percentage of battery manufacturing/assembly in North America is greater than or equal to the percentages listed above, the NCV may qualify for a credit of $3,750.00.

“Country With Which the United States Has a Trade Agreement in Effect”

To determine whether a critical mineral will qualify under the IRA, Treasury proposes that the phrase “country with which the United States has a free trade agreement in effect” means the countries with which the United States has comprehensive free trade agreements that have been approved by Congress and incorporated into statute.[1] The Proposed Regulations also state that Japan should be included as a country that has a Section 30D “free trade agreement,” based on the recently-concluded U.S.-Japan critical minerals agreement.

The inclusion of the U.S.-Japan critical minerals agreement broadens the definition of free trade agreements because the U.S.-Japan critical minerals agreement has not been enacted into statute. Although no other countries beyond those named in the Proposed Regulations currently meet the free trade agreement criteria, the broadening of the definition to something short of a standard free trade agreement provides opportunities for other countries to secure similar treatment.

To facilitate inclusion in the country list, Treasury also proposes to identify additional countries in the future based on an agreement between the United States and that country, which satisfies four criteria:

- Reduces or eliminates trade barriers on a preferential basis;

- Commits the parties to refrain from imposing new trade barriers;

- Establishes high-standard disciplines in key areas affecting trade (such as core labor and environmental protections); and/or

- Reduces or eliminates restrictions on exports or commits the parties to refrain from imposing such restrictions.

Treasury states that it may amend the country list to add certain countries that satisfy the above criteria, or remove a country from the list if such country’s free trade agreement has expired, terminated or been modified. We expect that if the proposed EU-U.S. critical minerals agreement is successfully concluded that it will satisfy the criteria above to qualify for Section 30D.

“Final Assembly Requirement”

The IRA requires NCVs to undergo final assembly in North America to be eligible for the Section 30D credit. New Section 30D(d)(5) defines “final assembly” as the process by which a manufacturer produces a new clean vehicle at, or through the use of, a plant, factory, or other place from which the vehicle is delivered to a dealer or importer with all component parts necessary for the mechanical operation of the vehicle included with the vehicle, whether or not the component parts are permanently installed in or on the vehicle. Treasury’s Proposed Regulations establish that a taxpayer could rely on the following information to determine where final assembly occurred: (1) the vehicle’s plant of manufacture as reported in the vehicle identification number (VIN) pursuant to 49 CFR 565; or (2) the final assembly point reported on the label affixed to the vehicle as described in 49 CFR 583.5(a)(3).

“Foreign Entities of Concern”

Section 30D(d)(7) provides that some vehicles are excluded from the availability of the credit, including when any of the applicable critical minerals contained in the battery were extracted, processed, or recycled by a foreign entity of concern or if any of the components contained in the battery were manufactured or assembled by a foreign entity of concern.

The Proposed Regulations do not define this requirement further and instead state that Treasury intend to issue guidance “at a later date.”

Impact of Proposed Regulations

In order to comply with the requirements laid out in the New Clean Vehicle Credit, EV manufacturers will need to map their procurement chains and fully understand all of their production steps to produce NCVs that qualify for the tax benefits.

Comments on Treasury’s rulemaking are due 60 days after publication, which is currently scheduled for April 17, 2023. Interested parties are encouraged to file comments. Cassidy Levy Kent continues to monitor developments in this area and is prepared to advise parties on this process as needed.

[1] These countries are Australia, Bahrain, Canada, Chile, Colombia, Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras, Israel, Jordan, South Korea, Mexico, Morocco, Nicaragua, Oman, Panama, Peru, and Singapore.