Today, the Canadian Parliament adopted Bill S-211, the Fighting Against Forced Labour and Child Labour in Supply Chains Act, a new law that aims to combat forced labor and child labour in supply chains. The soon-to-be law imposes a reporting requirement for certain covered “entities”.

We have previously reported on the requirements of this new law here. In this post, we provide a FAQ addressing each of the key elements.

When is the first report due?

The first report will be due between January 1, 2024 and May 31, 2024.

Who Must Publish a Report?

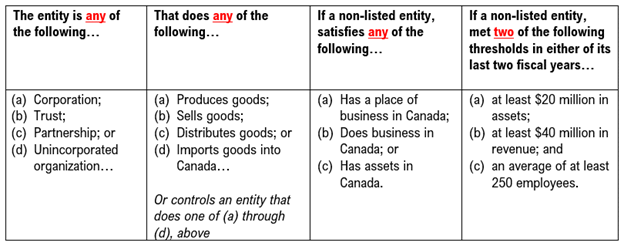

A business listed on a Canadian stock exchange is subject to the reporting requirement if it satisfies the first two boxes below.

A non-listed business is subject to the reporting requirement if it satisfies each of the four boxes below.

Are foreign-incorporated businesses exempt from the reporting requirement?

No. Companies are subject to the reporting requirement based on the thresholds set out above. There is no exemption for businesses registered or incorporated outside of Canada.

What must be reported?

The law requires companies to “report to the Minister on the steps the entity has taken during its previous financial year to prevent and reduce the risk that forced labour or child labour is used at any step of the production of goods in Canada or elsewhere by the entity or of goods imported into Canada by the entity.” In other words, between January 1, 2024 and May 31, 2024, a company must report on steps taken in 2023 to prevent and reduce the risk of forced or child labour in its supply chain.

The law also sets out seven additional categories of required items. Those items are:

- its structure, activities and supply chains;

- its policies and its due diligence processes in relation to forced labour and child labour;

- the parts of its business and supply chains that carry a risk of forced labour or child labour being used and the steps it has taken to assess and manage that risk;

- any measures taken to remediate any forced labour or child labour;

- any measures taken to remediate the loss of income to the most vulnerable families that results from any measure taken to eliminate the use of forced labour or child labour in its activities and supply chains;

- the training provided to employees on forced labour and child labour; and

- how the entity assesses its effectiveness in ensuring that forced labour and child labour are not being used in its business and supply chains.

At this time, there is no indication about how extensive a company’s reporting must be for each of the listed items or whether a company must address all items to be considered compliant. It is possible that the Government of Canada will publish guidance to assist companies in meeting this reporting requirement before the end of the year. We will of course update this publication if that occurs.

Where should you post the report?

Companies are required to submit the report to the Minister of Public Safety and Emergency Preparedness. The Minister will post reports on a public government website.

Companies must also post the report “in a prominent place on its website.”

Who has to approve the report?

The report must be approved by the governing body of the covered entity. That is, the people with primary responsibility for the governance of the company.

What are the penalties for failure to comply?

Companies that fail to comply with the new reporting requirements could face penalties of up to $250,000 CAD.

Directors and officers of subject companies may also be liable for conviction if the director or officer directs, authorizes, assets, acquiesces, or participates in the offence of the corporation.

Should we expect further forced labour legislation from Canada?

Yes. The Government of Canada has signaled that this reporting law is merely a “first step” in its fight to eradicate forced labour from Canada’s supply chain. We expect to see more aggressive laws soon. These would likely target enhanced enforcement to prevent goods produced with forced or child labour from entering into Canada.