Today, the Office of the United States Trade Representative (USTR) released the final version of its modifications to tariffs imposed on products of the People’s Republic of China (PRC) pursuant to Section 301 of the Trade Act of 1974. As summarized in several prior CLK Insights, these modifications arise out of USTR’s statutorily mandated four-year review of those Section 301 tariffs, after which the President directed USTR to maintain existing tariffs, increase tariffs on certain specific HTSUS subheadings, and open narrow tariff exclusions. The finalized modifications reflect relatively modest changes undertaken in response to the over 1,100 public comments received by USTR.

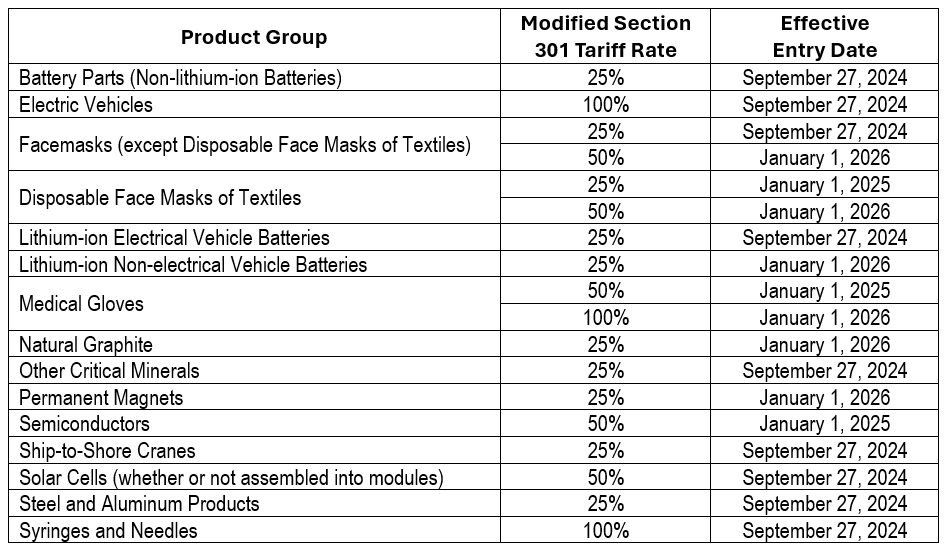

Products subject to tariff increases are summarized below. Detail on the HTSUS subheadings listed in Annex A of USTR’s modification notice.

The HTSUS subheadings eligible for consideration under USTR’s temporary machinery exclusion process can be found in Annex E of USTR’s modification notice. Originally, USTR proposed 312 eligible HTSUS subheadings and received over 650 comments on the scope of this exclusion process. The final modification includes all 312 originally proposed HTSUS subheadings and adds five others: 8421.21.00 (Machinery and apparatus for filtering or purifying water); 8421.29.00 (Filtering or purifying machinery and apparatus for liquids, not elsewhere specified or included); 8421.39.01 (Filtering or purifying machinery and apparatus for gases, other than intake air filters or catalytic conv. for internal combustion engines); 8428.70.00 (Industrial robots); and 8443.19.30 (Printing machinery, not elsewhere specified or included).

USTR declined to extend exclusion eligibility to any HTSUS subheading that covers only parts, accessories, consumables, or general equipment unable to physically change a good. And, in response to comments opposing the inclusion of certain HTSUS subheadings on the grounds that goods falling within those subheadings were available from non-PRC sources, USTR requested that interested parties express such concerns during the exclusion process itself, so that USTR can weigh those issues when deciding upon a particular exclusion request. CLK previously summarized the likely content of that exclusion process, but further details and timelines remain forthcoming.

Finally, exclusions for solar energy manufacturing equipment listed in Annex B of USTR’s modification notice are retroactive, with effect for any entry between January 1, 2024, and May 31, 2025.

CLK is available to assist parties whose business or supply chain may be impacted by USTR’s most recent modifications to the Section 301 tariffs.